Case 9: Ryka, inc.: Lightweight Athletic shoes for women

Ryka was founded by a couple, Martin P. Birrittella and Sheri Poe. In 1986, Poe had injured her back in the aerobics class and was convinced that the injury had been cause by her shoes, which had never fit properly. After she exhaustive try to search for footwear that would not cause her body stress, it occurred to Poe that many other woman were probably having the same trouble she was finding a shoe that really fit, then she decide to start her own woman’s athletic-footwear company.

Ryka time line history is as follows.

| 1986 | - Founded as ABE Corporation by a couple Martin P. Birrittella and Sheri Poe. |

| 1987, Feb | - Change the company name to Ryka Corporation and start its operation. |

| 1987, Sep | - Introduced first two style of athletic shoes. |

| 1988, Mar | - Began shipping the shoes. |

| 1988, Apr | - Became public company. |

| 1988, Oct | - Introduced nitrogen foot wear system, Nitrogen/ES - Win eight-year licensing agreement with the U.S. Ski team that permitted Ryka to market its product as team’s official training shoes. - American Aerobics Association International chose Ryka as the association’s preferred brand of aerobic. |

| 1989 | - Discontinued sales of models that did not Nitrogen/ES

system. - Shape magazine named Ryka number one in itts aerobic shoe category |

| 1990, Dec | - Introduction Ultra-Lite line (and Poe’s appearance on Oprah Winfrey show). |

| 1992, Sep | - Establish Ryka ROSE foundation, a

not-for-profit organization created by Sheri Poe to help woman who had been victims of

violent crimes. - Ryka was Premier Sponsor and official shoe of the Canadian National Aerobic championship held in Vancouver, B.C. |

| 1992, Oct | - Expand its direct marketing to consumer. |

| 1993 | - Expanded its dealer base to point where no single retail chain or group under common control accounted for more than 10 percent of its total revenue. |

Martn P. Birrittella

| 1980 – 1986 | - Vice President of sales and marketing, Matrix International Industries. |

Sheri Poe

| 1982 – 1985 | - National sales manager, Matrix International Industries. |

| 1986, May – 1987, Jun | - National account manager, TMC group. |

Dominant Economic Characteristics of the Industry Environment

Market Size

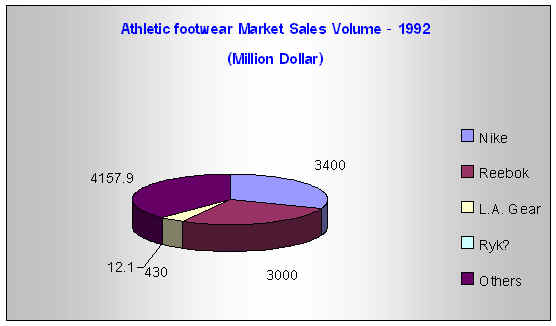

Figure 1: Athletic footwear market sales volume.

Growth Rate

Stage in Life cycle

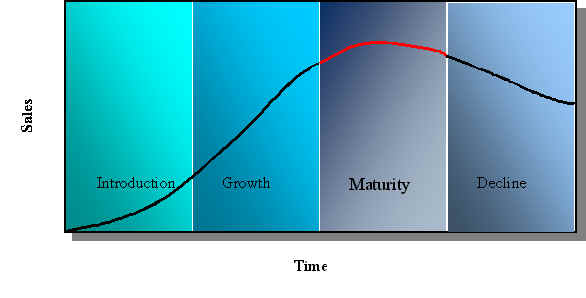

Figure 2: Industry stage in product life cycle

Nature of industry

Competitive Firms in the Industry

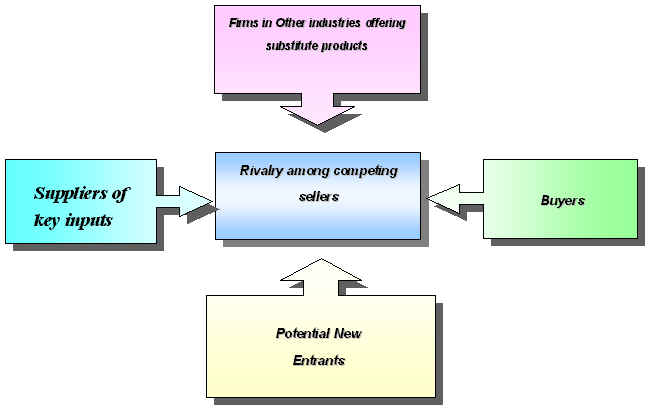

The five-forces Model of competition

In 1987, the industry as a whole grew at a rate of 20 percent, but by 1991 the annual growth rate in sales had shrunk to approximately 4 percent. The athletic-footwear market was considered a mature in 1993. Despite the subdued growth characteristics of the overall industry, however, a number of segments were rapidly expanding because of high specialization, technological innovation, and image and fashion appeal. Therefore, this industry can be classified as attractive.

1. Buyers

In this industry, Buyers have a strong power in their purchasing decision. Buyers can be moving their purchasing to competitors. Because, there are many companies that produce athletic-footwear such as Nike, Reebok, Adidas, L.A. Gear and so on. These companies are continue produce new product line and new model which are promptly to response each other in order to attract buyers. Therefore, buyers have many choices of product to choose. However, Most of buyers that buy Ryka are women who still have some brand loyalty.

2. Suppliers of key inputs

When look at the power of the industry’s suppliers, Ryka can gain a competitive advantage here because suppliers has low bargaining power in this industry. The principle raw materials in Ryka shoes were leather, rubber, ethylvinyl acetate, polyurethane, cambrelle, and pigskin, all of which were readily obtainable from numerous suppliers in the United States and abroad. Nevertheless, even though Ryka or its contract manufacturers could locate new sources of raw materials within a relatively short period of time if needed, Ryka’s outsourcing strategy of placing orders as needed with whichever contract manufacturers had the best price made it vulnerable to any unexpected difficulties in manufacturing or shipment. Ryka did not maintain large stockpiles of inventory to buffer any delays in deliveries from producers.

3. Potential new entrants

Because of mature market and high investment in this industry, there is low new entrant. It’ s hard to penetrate this business. New firms entering this industry need a lot of things to have in order to compete the existing companies such as high capital investment, high technology advancement, commit expensive R&D throughout the cycles of industry and produce creative, high quality, good image and lower price of athletic-footwear that can attract customers.

4. Firms in other industries offering substitute products

There is low availability of substitute goods in this market such as sport sandal, fashion shoes industry which difficult to substitute athletic footwear. However, in this athletic footwear industry other companies also produce fashion-athletic footwear, while Ryka had focused on performance rather than fashion because Ryka believed that fashion-athletic footwear was susceptible to faddish trends and to ups and downs in the economy, whereas the demand for performance shoes was based on the ongoing need of women to protect their physical well-being.

Nevertheless, a large segment of athletic-footwear consumers purchased footwear products based on looks rather than function. In fact, fashion and styling trends were a mainstay among Ryka’s major competitors. 80-90 percent of fashion aerobic-shoes buyers did not participate in aerobic but wore the shoes for casual use and other recreational purposes. Therefore, in the same industries, there is high offering substitute products.

5. Rivalry among competing sellers

Ryka has a lot of competitors. The $11-billion athletic-footwear industry was highly competitive. Three major firms dominated the market: Nike, Reebok, and L.A. Gear. Second-tier competitors included Adidas, Avia, Asics, and Converse. All these companies had greater financial strength and more resources than Ryka. While Ryka’s sales were $12.1 million in 1992, Nike’s were $3.4 billion, Reebok’s $3.0 billion, and L.A. Gear’s $430 million.

The Driving Forces are the important factors that cause the changing in industry and competitive conditions. There are several driving forces in the athletic footware industry:

1. Changes in the long-term industry growth rate.

In 1987, the athletic footwear industry as a whole grew at a rate of 20 percent, but by 1991 the annual growth rate in sales had shrunk to approximately 4 percent. This market also was considered a mature market in 1993. Though the industry growth rate tended to reduce, this market was still highly competitive.

Shifts in the decreasing of industry growth are a force for industry change because they affect the balance between industry supply and buyer demand, entry and exit, and how hard it will be for a firm to capture additional sales.

In the mature stage of the athletic footwear market, athletic-shoes companies had to have more than a good product to survive; they needed to pull customers to their products with advertising and celebrity endorsements and to push their brands through retail outlets, most of which stocked several brands. Furthermore, these companies were continually jockeying for a better market position and a competitive edge, as seen from the rapidly increasing of a number of segments.

2. Technological Innovation

Technological innovation is one of the reasons for the expanding of a number segments. The two major firms dominated the market: Reebok and Nike were the fastest toward the goal of being identified as the most technologically advanced producers of performance shoes. As the results, other companies had to keep up with the research and development in order to introduce the new and better product to compete with them. Ryka also introduce the new footwear system, Nitrogen/ES (the ES stood for Energy Spheres) in October 1988.

3. Product Specialization

The athletic footwear industry was divided into various submarkets by end-user specialization: basketball, tennis, running, aerobic, cross-training, walking and so on. The major firms dominated the market such as Nike, Reebok, and LA. Gear who had greater financial strength and more resources try to cover all these segments. However, the new entrance with limited budget like Ryka had to approach this market by narrowing target market. They offered the differentiated product to serve the special group of customer to compete with major competitors.

4. Change in who buys the product and how they use it. (Fashion)

Another reason of the expanding number of segments in athletic-footware market was fashion appeal. A large segment of athletic-footware consumers purchased footware products based on looks rather than function. The evidence was such that 80 to 90 percent of fashion aerobic-shoes buyers did not participate in aerobics but wore the shoes for casual use and other recreational purpose. From these behaviors, fashion and styling trends were a mainstay among the athletic footware firms.

5. Changing societal concerns attitudes, and lifestyles.

Emerging social issues and changing attitudes and lifestyles can instigate industry change. Increased interest in physical fitness has spawned whole industries in exercise equipment.

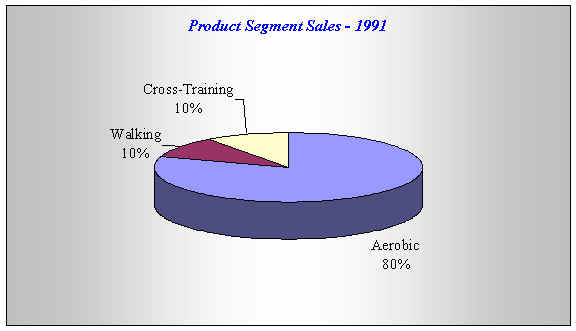

Ryka, Inc. design, developed, and marketed athletic footwear for woman. The athletic footwear industry was divided into various segments by end-use specialization. Ryka compete in 3 segments.

Figure 3: Ryka sales by product segment.

Ryka products are focus on performance rather than fashion. Its products contain these following product advancement:

Ryka product is design especially suited for woman’s feet and bodies. Who wanted a lightweight, high-performance shoe that was attractive, comfortable, and well suited for exercise and physical fitness program to prevent them injured from exercise such as back injured cause by unfit shoes.

The target customer group is woman 21 to 35 (45 to 55 for walking segment), who cared seriously not just about how they looked, but about physical fitness.

It focused on only three end-use specialized segments: aerobic, walking, and cross-training shoes.

The Ryka ROSE (Regaining One’s Self-Esteem) foundation was a not-for-profit organization, established in September 1992 by Sheri Poe to help woman who had been victims of violent crimes.

Poe had pledge $250,000 to founded this foundation and Ryka had made a commitment to donate 7 percent of its pretax profits to the foundation and to sponsor special fundraising events to help strengthen community prevention and treatment programs for woman who were victims of violent crimes.

Ryka included information on the foundation in brochures that were packaged with each box of shoes. Poe considered Ryka financial commitment to the ROSE Foundation a natural extension of the company’s commitment to women.

Strategic Performance Indicators

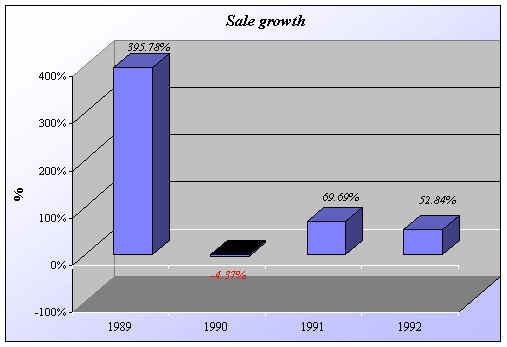

Sales growth

Figure 5: Ryka’s sales growth

- Successful from sell of its nitrogen footwear system, Nitrogen/ES shoe.

- Successful from boosting brand name recognition, named number one in aerobic shoe category by Shape magazine in 1989.

- Ryka products were sold through various channels such as sporting goods stores, athletic footwear stores, selected high-end department stores and sport-specialty retailers.

- Highly successful from selling in a trial basis by the second largest specialty-footwear retailer, FOOTACTION,

- Increasing sales through three large retail sporting goods chains to its distribution network

- Ryka’s marketing strategy by using Sheri Poe’s image and profile to stimulate the sales.

- The Ryka ROSE Foundation had created a good image in society responsible and appealed to its customers who appreciated the idea that their buying power was helping less fortunate women.

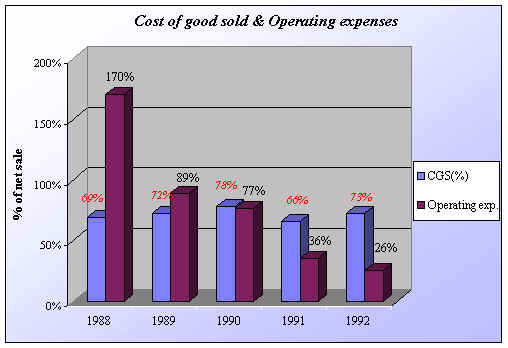

High Cost

Cost of good sold and operating expenses

Figure 6: Ryka’s cost of good sold & operating expenses

- In 1989, Ryka’s advertising expenses accounted for 51% of sale.

- Successful from promotional strategy by using “guerrilla-marketing tactics such as the Oprah show apperance reduced its operating cost.

- In 1993, Ryka’s advertising expenses accounted for 9% of sale.

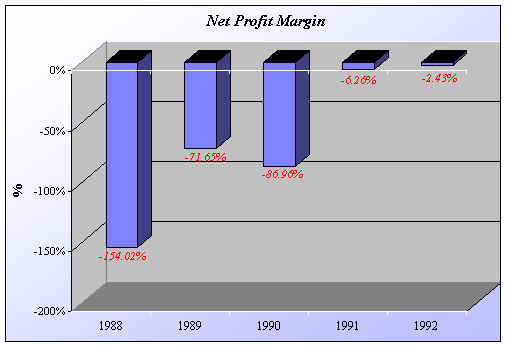

Profitability Analysis

Net Profit Margin increased

Figure 7: Ryka’s Net profit Margin

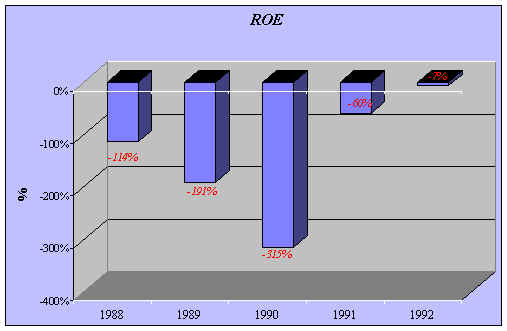

Return on stockholder’s equity (ROE) improved

Figure 8: Ryka’s Return on stockholder’s equity

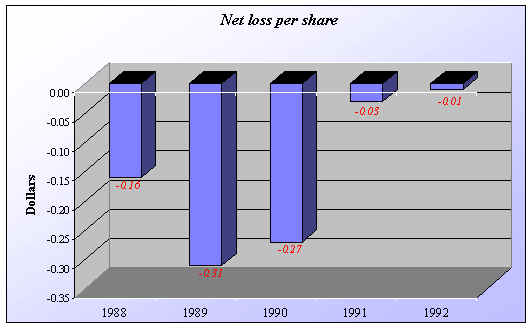

Net loss per share decreased

Figure 9: Ryka’s Net loss per share

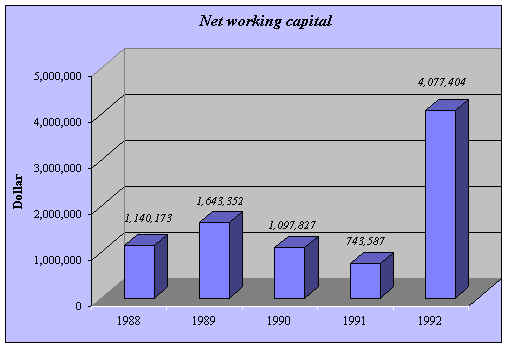

Liquidity Analysis

Net Working Capital

Figure 10: Ryka’s Net working capital

1991 |

1992 |

Percent Change |

|

| Cash and cash equivalents | 166,030 |

1,029,161 |

519.9% |

| Stockholders’ equity | 834,902 |

4,153,410 |

397.5% |

| Current assets | 4,367,255 |

8,199,411 |

87.7% |

| Current liabilities | 3,623,668 |

4,134,974 |

14.1% |

It should be note that “Working Capital and Short-Term Financing” excessive liquidity reduces ? firm’s risk of being unable to satisfy its short-term obligations as they come due but sacrifices profitability because current assets are less profitable than fixed assets.

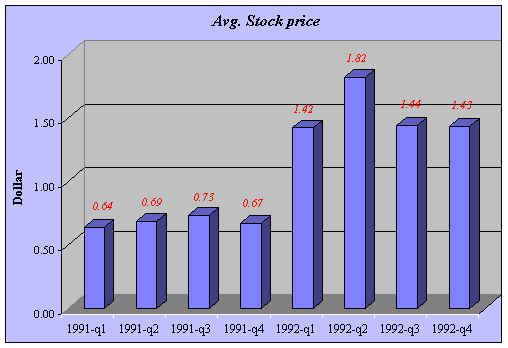

Stock Price Performance in 1991-1992

Figure 11: Ryka’s average stock price

Strengths

Small size business

Ryka has small size. This characteristic permitted agility and flexibility, enabling the company to implement changes quickly. When Ryka initial entered to footwear industry, there was high competition in the market and this industry was dominated by big brands. Athletic-footwear industry was divided into various submarkets. So Ryka with low financial decided to compete in women segment which it has high competency and high technology instead of launch products to compete in every segments of athletic-footwear market.

Outsourcing Strategy

By using outsourcing strategy allowed Ryka to get new designs into stores fast, and to respond promptly to increase or decrease in the sales of particular models.

Besides quickly respond to market demand, the outsourcing would help to minimized company investment in fixed assets and lower costs and business risk.

Moreover, short-term contract with outsourcers allowed Ryka to avoid risks from volatile exchange rates, the potential for trade disputes and tariff adjustments, the risk of foreign political upheaval, and a strong desire to avoid heavy dependence on one supplier.

Focus on market niche

While industry leaders like Nike or Reebok ignored niche market, Ryka focused on the most cost-effective ways to reach its narrow target market. Ryka's approach was to offer similar products but focused on only 3 segments instead of compete with all various submarkets. The core product of Ryka was aerobic shoes, walking shoes, and cross-training shoes. Ryka designed and manufacture shoes specially women who want lightweight, high performance shoe that was attractive, comfortable and well suited for exercise and physical fitness programs. None of the other companies in the athletic-shoe industry could designed their shoes exclusively fpe physical characteristics and needs of women. Big shoes companies were typically smaller sizes of men shoes to be women's shoes line. Ryka "Ultra-Lite" was the most significant and successful product advancement that put Ryka on a par with or perhaps ahead of competitors in term of product attributes. Ryka's Ultra-Lite's sales volume was closed to 90% of its $8.8 million in gross sales for 1991. Market recognized Ryka as a core brand in the women's athletic market.

Foundation built Ryka's image

Sheri Poe's foundation under the name "Ryka ROSE (Regaining One's Self-Esteem) helped to build company and product image.

Technological Innovation

Ryka was as good in technologically advanced as Reebok and Nike. Ryka succeeded in Nitrogen/ES and Ultra-Lite, innovative footwear. The ES ambient air compression spheres contained nitrogen microballoons that provided significantly more energy return than the systems of any of Ryka’s major competitors. Also Ultra-Lite, Ryka offered lightweight shoes for women than the competitors do.

Strong relationship with instructors

Ryka built relationship with the aerobics profession which later help Ryka boosted sales volume, promoted Ryka name, and developed product innovative. Instructors and students in their classes feedback helped Ryka become the first manufacturer to respond to the new step-aerobics trend by developing and marketing lightweight shoes specifically designed to support up-and-down step motions.

Weakness

No inventories

Ryka's drawback was it never had inventories. So after Poe was interviewed on Winfrey's popular talk show, Ryka products were shot. Retailers received thousands of requests for Ryka products from customers, and the sharp upturn in demand quickly exhausted the company's inventories. Ryka had to take over three months to catch up with the orders. Therefore Ryka might not be able to capitalize on the success of its new line because Ryka's competitors quickly came out with a line of lightweight aerobic shoes.

Limited financial resources

Ryka was a new entrant in highly competitive athletic-footwear industry with low-budget. It entered while well-known giants with high sales volume dominated this industry. Because of limited financial resources, Ryka couldn't capture all segments in the market and could not spend too much money for advertising to build brand awareness. Moreover, Ryka might lose its technology by easy copy from giant companies like Nike or Reebok because it did not have money to fight in the court.

Higher overall unit costs relative to key competitors

Ryka's product cost were higher than those of larger companies for several reasons:

Narrow product line

Ryka launched a few products into the market while its competitor launched various styles to capture all segments. The narrow product line caused Ryka lost sales in other segments of athletic-footwear.

Low quality products from outsourcing

Sometime Ryka couldn’t control quality of products from outsourcing company for example in Taiwan. This problem made Ryka high risk to commit customers and high cost to control them.

Opportunities

Easy to find raw material

Raw material for shoes were leather, rubber, ethylvinyl acetate, polyurethane, cambrelle, and pigskin. They all were easy to obtain from numerous suppliers in United States and all over the world.

Fast growing in women footwear segment

Despite the subdued growth characteristics of the overall industry, however, a number of segments were rapidly expanding because of high specialization, technological innovation, and image and fashion appeal. Athletic footwear for women was the fastest growing segment of the athletic-footwear market. The data showed that women's athletic footwear accounted for 55 percent of Reebok's sales, 60 percent of Avia's sales, 45 percent of L.A. Gear's sales, and 17 percent of Nike's $2.2 billion in domestic sales. In each segment that Ryka focused on had beautiful trends. Aerobic market had grown rapidly, its annual sales were approximately $500 million and almost consumers were women. In walking segment was also high-growth. 70 million people walked for exercise and the primarily focused on women 45 to 55 years old which was target group of Ryka. Also cross-training shoes were popular because they could be used for a variety of activities.

No shoes in the market fit to women demand

Many people had injured in aerobic classes and this trouble caused by shoes. Poe found that there were no shoes in the market fit properly. Giant brands paid attention to produce products depended on fashion instead of for physical health. So Poe stared to search for new fit shoes by her own company and offered to women demand.

Threats

Many competitors in the market

Athletic-footwear industry was already crowded. The various competitors were continually jockeying for a better market position and a competitive edge. Well-known companies that acquire major market share were Nike, Reebok, L.A. Gear. The others are Adidas, Avia, Asics, Converse, and so on.

Slowdowns in market growth

In 1987, the industry as a whole grew at a rate of 20 percent, but by 1991 the annual growth rate in sales had shrunk to approximately 4%. The athletic footwear market was considered a mature market in 1993. So it was hard for Ryka to expand products in athletic-footwear market.

Purchased Supplies and Inbound Logistics

The principal raw materials in Ryka shoes were leather, rubber, ethylvinyl acetate, polyurethane, cambrelle, and pigskin. These materials were readily obtainable from numerous suppliers in the United States and abroad. Ryka gives the authority to a Far Eastern buying agent, under Ryka’s direction, for the selection of suppliers. From this method, it creates both the benefit and the disadvantage.

Advantage:

Disadvantage:

Operations

Outsourcing: Ryka shoes were made by independent manufacturer in Europe and Far East, including South Korea and Taiwan, according to Ryka product specifications.

Short-term contract: Ryka preferred to make the short-term contract with manufacturers.

Advantage:

Disadvantage:

Distribution and outbound logistic

Ryka products were sold in sporting good stores, athletic footwear stores, selected high-end department stores (Nordstrom’s) and sport specialty retailers including Foot Locker, Lady Foot Locker, Athlete’s Foot Store, FOOTACTION, U.S. Athletics, Oshman’s, MC Sporting Goods, Tampa-based Sports and Recreation and Athletic Express. The biggest retail dealer was Lady Foot Locker, which 476 stores in the United States and 250 stores in Canada. As of 1993, Ryka had expanded its dealer base to the point where no single retail chain or group under common control accounted for more than 10 percent of its total revenue.

Marketing

As the new entrant and limited budget, Ryka had select the niche market, especially the athletic shoes for women. Its promotional strategy was aimed at creating both brand awareness and sales at the : retail level. The methods used for marketing are as follow

Sponsor the sport team and match

Direct marketing to aerobics instructors

Ryka considered that the most effective way to reach female aerobic niche was by promoting its shoes to aerobic instructors. Because if the instructors use and prefer Ryka’s shoes, they can introduce it to their students

Dealer Relationship

Ryka tried to make a good relationship with its retailers by :

Advertising

Giving premium

Ryka also gave the premium such a fanny packs or water bottle for customers.

Guerrilla market tactics

Ryka used the Guerrilla marketing technique by the appearance on the show of Oprah Winfrey to build the brand recognition of its products. (explain on the strategy analysis).

Poe’ s Image

Using Poe’ s image and profile to be the major component in Ryka’ s marketing strategy. Ryka did not use the celebrity endorsements like the other big competitors. However, it used its president’ s image a working woman who offers the product for women and support to women to inspire other women to buy the company product.

The company image from Ryka ROSE Foundation

- Since Sheri Poe established the Ryka ROSE Foundation to help women who had been victims of violent crime, it also created the preference image to the company as an ethical company. Poe believed that the foundation would appeal to customer who appreciated the idea that their buying power was helping less fortunate women.

- Ryka also involved its retailers in this market socially responsible program direct to women. For example, Lady Foot Locker conducted a two-week promotional campaign by distributing free education brochures and holding ? special sweepstakes contest to raise awareness about violence against women.

Research

Ryka developed innovation product and response to the new step aerobics trend from closely relationship with the aerobics professor. Aerobics instructor’ suggestion based on their own experience as well as on feedback from student in their classes has led to such improvements as well as effective cushioning, better arch support, and lightweight shoes specifically designed to support up-and-down step motion.

Technology

Ryka was strong in term of technology as well as its competitors such as Nike or Reebok. Ryka usually do the research and development for producing innovative product and launch to the market. Nitrogen/ES (The ES stood for Energy Spheres) was one of successful product of Ryka. The ES ambient air compression spheres contained nitrogen microballoons that provided significant more energy return than the systems of any of Ryka’ s major competitors. The result was customer response to Nitrogen/ES so excellent.

Human Resource Management

Ryka employed experience executive from any companies to manage itself. When Ryka was in its start up mode, Sheri Poe used industry-standard salaries, stock options, and the opportunity for significant input into the day-to-day operations of the company to attract four top executives from Reebok for the position in sales, advertising, and public relations. Also, in Nov 1992, Ryka appointed Roy s. Kelvin, a former New York investment banker, to be vice president and chief financial officer by hope that he would help Ryka raise capital to finance the company’ s growing operating requirement.

1. Technological Skill

Ryka’s shoes were the technologically advanced by the nitrogen/ES. This system offered more energy return than the systems of any of Ryka major competitor.

2. Distribution Capability

Ryka products were sold all over the world through many big retail sporting goods networks. These distributions have many outlets which allowed Ryka to approach to customer easily.

3. Marketing Related KSFs

Ryka selected the right segment, which was the athletic footwear for women. This segment was the fastest growing segment of the athletic footwear market. Ryka also focus primarily on aerobics shoes and secondarily on walking shoes which were the high growth segment.

As a new entrant into the highly competitive athletic-footware industry, Ryka had to rely on low-budget, guerilla-marketing tactics such as the Oprah Show appearance to create brand awareness.

Also the use of the direct market to the aerobic instructors who are both customers and promotion channel was another successful marketing tactic.

4. Skill Related KSFs - An ability to develop innovative products and products improvements

As the results of good relationship with customer such as the aerobic instructors, Ryka could take the benefit from their suggestion in term of developing product design innovations and product improvements. These had let Ryka to offer the product that suit for customer needs. The Ultra-Lite aerobic shoes were an example that Ryka was developed from these suggestions and was the most successful product advancement.

5. Favorable image / reputation with buyers.

Ryka have the good image with buyers. As a result of “the Ryka ROSE Foundation”, the Ryka had garnered the reputation as an ethical company, which concerned about the social issues, Not only was it the athletic footwear company that for women, by women, it supported women.

Furthermore, the image of “Sheri Poe” the Ryka’ s president as a down-to-earth women who just happened to be a successful executive and was a mother was another factor supporting the company image.

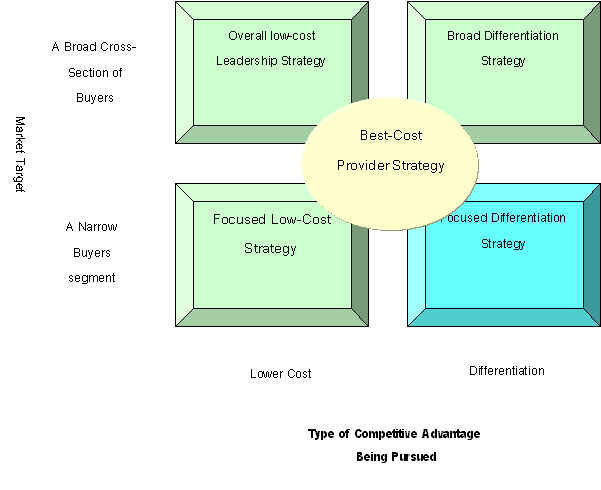

Competitive strategies

The objective of competitive strategy is to do a significantly better job of providing what buyers are looking for. This strategy will focus on whether a company's market target is broad or narrow and whether it is pursuing a competitive advantage linked to low costs or product differentiation.

Ryka used a focused or market niche strategy based on differentiation. This strategy is concentrating on a narrow buyer segment and outcompeting rivals by offering niche members a customized product or service that meets their tastes and requirements better than rivals' offerings.

While athletic-footwear industry crowed and was divided into multisegment, women footwear was the fastest growing segment of this market. When Ryka entered to athletic-footwear market, it tried to compete with challenge competitors by capturing the market niche. The focused strategy was appropriate for Ryka which was a small company with low financing, and did not have the resources or capabilities to go after a bigger piece of the total athletic-footwear market. Ryka focused on special product attributes that appeal to niche members. Rika had developed a fitness shoe crafted specifically for women's feet and good for physical which none of he other companies in the athletic-shoe industry did before. The differentiation of product that customers feel better perceive than products form its rival led Ryka to be successful in Ultra-Lite aerobic shoes, its core competency product.

Outsourcing Strategies

As was common in the athletic-footwear industry, Ryka shoes were made by independent manufacturers in Europe and the Far East, including South Korea and Taiwan, according to Ryka product specifications. The company relied on Far Eastern buying agent, under Ryka’s direction, for the selection of suppliers, inspection of goods prior to shipment, and shipment of finished goods. Ryka’s management believed that outsourcing its footwear products minimized company investment in fixed assets and lowered costs and business risk. Therefore, this strategy help firm perform better or more cheaply by outside manufacturers.

Guerrilla Offensives

Guerrilla offensives are particularly well-suited to small challengers who have neither the resources nor the market visibility to mount a full-fledged attack on industry leaders.

As a new entrant into the highly competitive athletic-footwear industry, an industry dominated by well-known giants with sales in the billions, the fledgling Ryka Corporation had no choice but to rely on low-budget, guerrilla-marketing tactics such as Oprah show appearance; during the past year, Poe had sent several free pairs of Ryka athletic shoes to Oprah Winfrey, and today Poe was featured as a successful female entrepreneur on Winfrey’s popular talk show with a television viewing audience numbering in the tens of millions-almost entirely women. Ryka’s new line of Ultra-Lite aerobic shoes had just began to penetrate the retail market. After the Oprah broadcast, the Ultra-lite line became an overnight success. Lady Footlocker immediately put the Ultra-lite shoe line in 200 stores, up from the 50 that had been carrying Ryka’s regular line of athletic shoes. Retailers received thousands of requests for Ryka products from consumers, and the sharp upturn in demand quickly exhausted the company’s inventories. Therefore, Ryka can surprise rivals and gain market share by using this tactic.

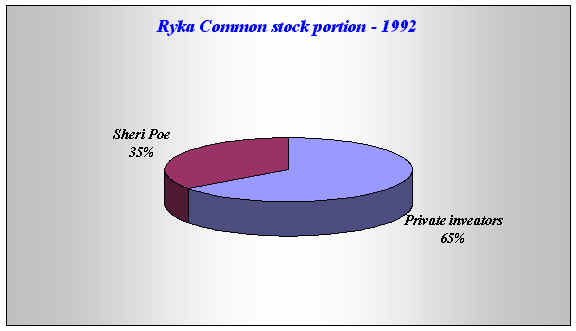

1. Financial Improvement

Since Ryka founded company, it principally financed by issuing common stock. But during 1991-1992, Ryka’s stock price did not have a good price. Also Ryka’s policy had never paid dividends and did not plan to pay dividends in the foreseeable future. This policy did not satisfy shareholders and did not attractive investors to invest in Ryka’s stock. So Ryka should find new way for financing funds instead such as financing fund from long term debt.

2. Reducing operation cost

High cost of this company came from manufacturing process that Ryka employed outsourcing. Ryka had to pay additional cost for its products in order to achieve and maintain higher quality. Also including commissions and fees cost. Ryka should make strong relationship with outsourcing to gain bargaining power. Also Ryka should do forecasting sales volume in each period for controlling risk and additional cost.

3. Develop better products to serve customers need and more focus in walking segment

Ryka should develop innovative products and focused on both performance and fashion at the same time to reach customer demand. Besides aerobic segment that Ryka had succeeded, walking segment was a new segment that Ryka expected to be a greatest growth category. So Ryka should use its capability in technological advance to develop products in this segment and continue capture customer differentiate demand.

4. Continue focusing on a few market segments where the company’s resource strengths and capabilities can yield a competitive edge

Ryka was successful in aerobic segment after employ market niche strategy. Therefore Ryka should continued this strategy by searching for new segment in athletic footwear to continue its success.

5. Commit R&D and developing technical expertise

Ryka should do R&D continuously in order to develop innovative products to market. In addition, Ryka should develop technical expertise that will be highly valued by customers. It can help to produce performance shoes to compete competitors promptly.

6. Merge with other companies

As athlitic-footwear was in maturing industry, Ryka was one of new entrace firm with both financial and resources. Ryka never got profit all the time it had operated. One way to strengthen a company’s position is to merge with other companies that have more competitive strength in term of Ryka’s weakness. The Ryka’s strength that could exchange to its partners was its technologically advance.